Something for your Espresso: Goldilocks vs Deindustrialisation?

Good Morning Everyone!

Last night was quite eventful, and if Gaetz isn’t just posturing or misled, it could be that McCarthy has potentially undermined his own position by delaying the eagerly anticipated US Government Shutdown. We will be closely monitoring the situation and anticipate that developments on Capitol Hill will significantly influence the financial markets in the weeks ahead. A prolonged shutdown could potentially trigger a recession, while substantial fiscal cuts might weaken the USD’s impressive performance over the past 10 weeks- so plenty of stakes on the table at the moment and we will be monitoring the situation closely

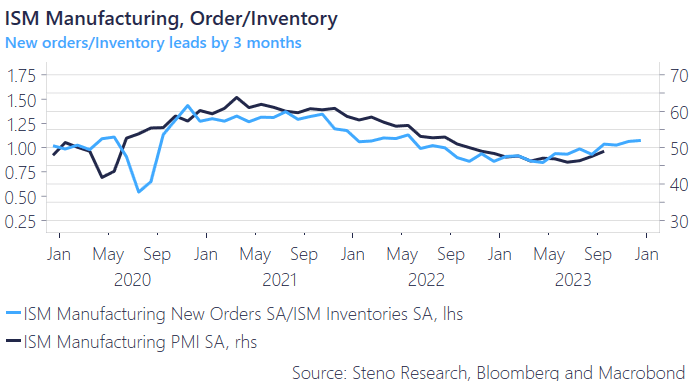

We’re still elated about hitting the bullseye with the ISM Manufacturing data outperforming market expectations. Our predictive models all concurred on a higher likelihood of a positive surprise, and the current order/inventory situation remains favorable for the rest of the year:

Chart 1: ISM manufacturing: Order/Inventory

We hit the bullseye with the ISM Manufacturing data, but the upcoming weeks may present challenges as Capitol Hill gears up for another political spectacle. Meanwhile, across the Atlantic, the European situation may be less dramatic, but they find themselves in a tight spot nonetheless

0 Comments