Something for your Espresso: Do markets even care about CPI today?

Morning from Copenhagen.

Presidential debates are always interesting, especially given the significant differences between the two candidates and their economic policies. This is likely why we are seeing markets react as they are.

Now that the dust has somewhat settled, a Harris victory seems even more certain, with both the USD and equities selling off as a result. This reaction is noteworthy in itself. The “dash for cash” dynamics that were brewing beneath the surface during tax season, from a liquidity perspective, have paused (for now at least) ahead of the CPI report.

Interestingly, breakevens are slightly higher today, despite Trump being considered the more “inflationary” of the two candidates—recall inflation swaps trading higher when he was elected back in 2015.

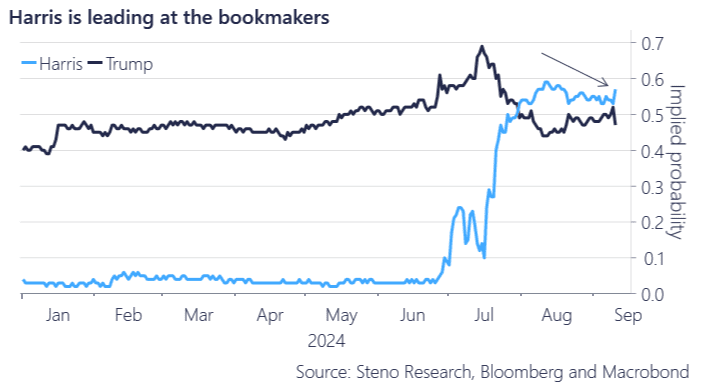

The implied probability of a Harris win has jumped four percentage points after the debate. However, we’ll see if this perceived Kamala victory will continue to dominate markets, as the initial effects seem to be fading going into the London open. I don’t think Trump should be ruled out just yet, as his voter base is likely to remain steadfast after tonight’s debate. Still, Harris’s victory today is hard to dispute.

Chart 1: Bookmakers Favor Harris Post-Debate—Will It Dictate Markets?

The Kamala victory in today’s debate as temporarily paused the dash for cash dynamics in the USD, while other September seasonalities continue to roar in Fixed Income and equities ahead of the US CPI release today. Do markets even care about inflation anymore? A hot(ter) print might not be bad for risk assets here.

0 Comments