Something for your Espresso: Disturbance in the force

Good morning everyone!

G It appears we experienced some relief in the Asian markets last night, following a positive Thursday for Western equities.

From the Asian session, it seems that Chinese economic activity is showing signs of recovery, as we had previously anticipated amidst the prevailing pessimism and that the Bank of Japan is buying more JGB’s – something to follow in the coming weeks.

As for yesterday, It will be interesting to see if we observe a repeat of yesterday’s trend on this final trading day of the week.

What stood out even more than the price movements yesterday was the data we received on the US economy. Personal consumption came in at 0.8%, significantly lower than the expected 1.7%. This is a development we will need to consider as we head into next week.

I mentioned in an article earlier this summer that the dominant theme for the second half of 2023 would be growth risk. It appears that this theme is still relevant, despite the US economy not showing signs of a significant downturn. With the latest local inflation prints from Europe in mind, it seems there is increasing evidence that the underlying inflationary pressures are resistant to the immediate impact of energy prices:

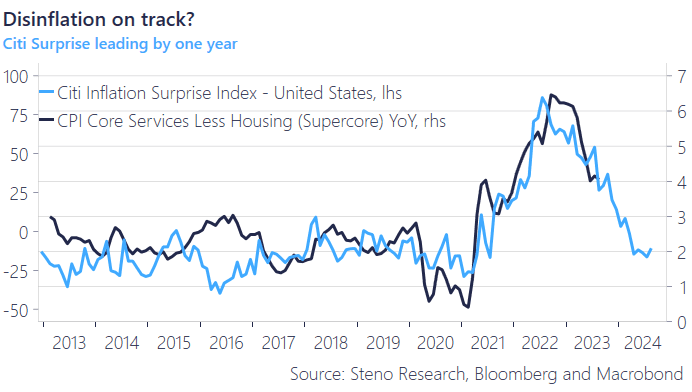

Chart 1: Citi Surprise vs Supercore YoY

Numerous unsettling macroeconomic forces are at play these days, and we’ll discuss some of them in today’s morning report

0 Comments