Something for your Espresso: Bend or Break

Good morning from Europe

Back in the spring, I wrote an article about how large companies with substantial cash reserves and minimal financing needs would gain a significant advantage in this economic cycle. Needless to say, if you’ve been following the performance of equities, that assertion has proven to be even more extreme than what I initially anticipated.

Since then, I’ve become slightly more cautious about the equity markets. It was evident that profit margins would start to shrink while real wages were set to rise as wage-earners would want compensation from inflation.

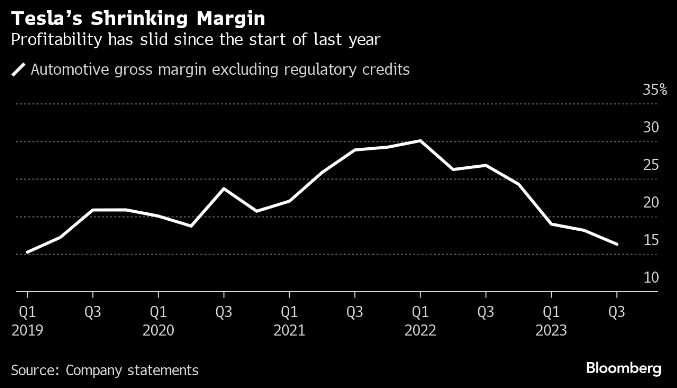

In my view. industries selling big-ticket products were among the most vulnerable to this dynamic, given the simultaneous surge in financing costs. Tesla’s recent earnings release may serve as a harbinger of broader trends in the near future

Profit margins are currently on a downward trajectory for Musk

Chart 1: Tesla Margins, Bloomberg

Restocking and US consumers keeping up relentlessly. We think it is bound to come to an end soon. Read here why

0 Comments