Something for your Espreso: Crude Capitulation?

Good morning from Europe!

Markets move fast these days and what seemed to be an imminent supply squeeze riding on geopolitical panic has now reversed in the short span of a month.

While it is feasible that markets initially overreacted (as they often do) to the tragedy unfolding in Gaza it is by no means self-evident that the current geopolitical situation in the region is more stable and poses less of a risk scenario than in October.

Some considerations we found noteworthy within the past couple of days: a statement from the US Central Command official twitter account goes:

“Following a series of attacks against U.S. persons in Iraq and Syria, U.S. Central Command (USCENTCOM) forces conducted an air strike against a facility in Syria used by Iran’s Islamic Revolutionary Guard Corps (IRGC) and affiliated groups. We will take all necessary measures to defend our people against those who are responsible for the attacks and will respond at a time and place of our choosing.”

From the other side, the Houthi’s are reported to have shot down a US drone (see here).

It’s safe to say that US military presence is currently complicating matters for Tehran and the recent sanctions on Iran that passed by the US House (see here) are unlikely to ease tensions.

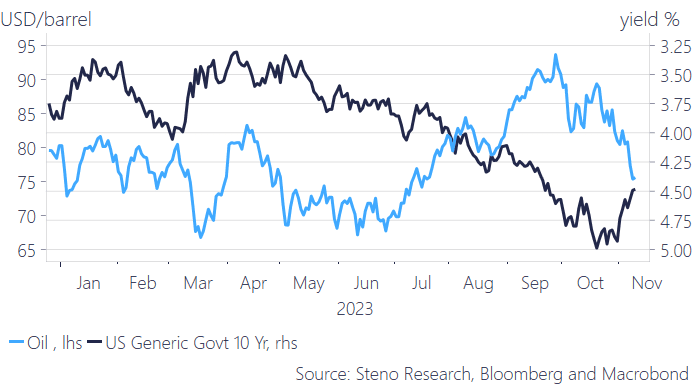

Yet price action has scarcely mirrored what one might have expected: Yes, Oil and bonds are to an extent intrinsically linked, but we bond rally is not quite as strong as the Oil selloff thus far

Chart 1: Oil vs US10y Yield

Oil and bonds have recently taken divergent paths, and we believe it’s worth pondering the factors behind this recent price action. Read our morning thoughts below

0 Comments