Something for your Espresso: We got it right. Now what?

Good morning!

A victory lap after a bullseye forecast here but we can’t live on yesterday’s highs. As we wake up to smell the coffee here are some reflections on the side

I always found the whole “transitory” vs “Back to the 70s” debate that emerged after the Covid stimulus Bazooka rather silly. Simple textbook insights would tell us that a massive one-off monetary expansion would result in an inflationary shock and a permanently higher price level. But in order for the rate of change in prices (inflation) to keep up, the policy would have to accommodate so on an ongoing basis. Alas, I was pretty astonished when the FED was keeping rates low and buying just about every available-for-sale bond off the market as the Biden Administration threw money around left, right and center in 2021.

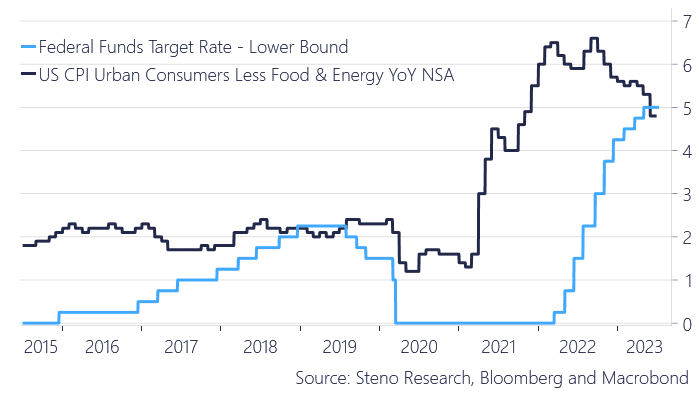

As the tightening cycle began, it became evident that the majority of stakeholders, including the bond market, had been overly optimistic in their expectations for inflation to subside. Still, here we are with Core (less energy and food) below FFR:

Chart 1: FFR Lower Bound vs Core CPI

Dovish print as we expected. But as we celebrate the progress we ought to ask whether the price of additional disinflation won’t start to rise

0 Comments