Crypto Moves #32 – Exploring the U.S.-based Bitcoin ETFs Basis Trade

On Monday’s Crypto Crisp, we briefly discussed the Bitcoin basis trade, a strategy in futures markets that exploits the difference between an asset’s spot price and its futures price, known as the ‘basis.’ Since this strategy involves taking both long and short positions of similar size, it is considered market-neutral, meaning it does not by default impact the asset’s price.

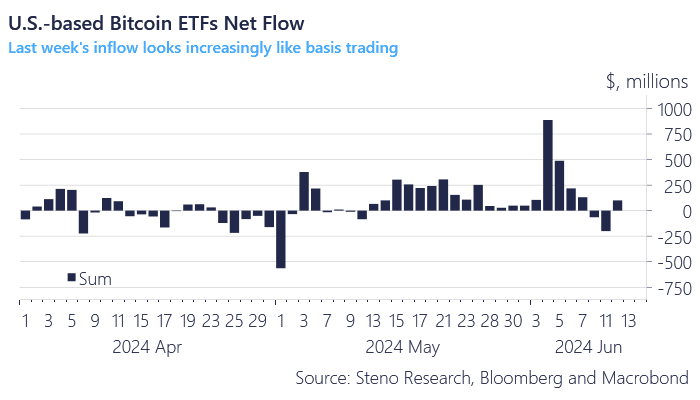

Given its market-neutral nature, one might wonder why the Bitcoin basis trade is worth discussing. The answer lies in its relevance to the inflows into the newly-launched U.S.-based Bitcoin spot ETFs. Last week, these Bitcoin ETFs saw inflows of $1.829 billion, which was widely celebrated by the industry. At first glance, this suggests robust demand for Bitcoin ETFs, prompting other market participants to buy bitcoins, further driving demand.

However, it seems that a significant portion of last week’s Bitcoin ETF inflows might be attributed to basis trading. This implies that these inflows were market-neutral as traders simultaneously opened short positions. In Monday’s Crypto Crisp, we estimated that up to half of last week’s ETF inflows, approximately $900 million, resulted from basis trading. We also noted:

“With Bitcoin’s funding rate decreasing from about 13.89% to 4.53% annualized within a week, we expect either an outflow from the ETFs this week or at least a limited inflow as traders close their basis trades. We will monitor this closely, as it will help us assess whether future significant Bitcoin ETF inflows are driven by direct buying pressure or predominantly by arbitrage.”

This prediction has proven accurate. In the first three trading sessions of this week, U.S.-based Bitcoin ETFs experienced an outflow of $64.9 million on Monday and $200.4 million on Tuesday, followed by an inflow of $100.8 million on Wednesday. This results in a net outflow of $164.5 million so far this week.

Chart 1: U.S.-based Bitcoin ETFs Net Flow

This suggests that the crypto industry should not celebrate Bitcoin ETF inflows unreservedly, as each dollar of inflow does not necessarily equate to one dollar of buying pressure on Bitcoin.

There are two primary methods for executing basis trading in the Bitcoin markets. The first involves acquiring Bitcoin spot ETFs and potentially using these ETFs, along with cash and other assets, as collateral to open short positions in the CME futures market. By doing so, traders earn the often-present positive rolling yield, as Bitcoin futures typically trade at a premium to the spot price, known as contango. By holding a short position in the futures until expiry or close to it, the futures naturally trade closer to the spot price of Bitcoin, allowing the trader to profit from the difference.

The second method involves basis trading on crypto-native exchanges. Here, traders acquire spot Bitcoin and use these bitcoins, possibly with other assets, as collateral to fund a short position in the Bitcoin perpetual futures market. Unlike CME futures, perpetual futures do not expire and trade close to the spot price. To maintain this proximity, perpetual futures use a funding rate mechanism. When the perpetual futures trade at a premium, the funding rate is positive, and longs pay shorts. Conversely, when perpetual futures trade at a discount to the spot price, shorts pay longs. Often, the funding rate is positive, leading longs to pay shorts. By utilizing a basis trade, the trader profits from the funding rate. However, this strategy involves using crypto-native exchanges, which increases the counterparty risk of the trade.

It is also possible for a market participant to use a combination of both methods, such as being short CME futures while long spot Bitcoin or short perpetual futures while long Bitcoin ETFs.

With this understanding, let us examine what the Bitcoin futures market indicates about the inflow into U.S.-based Bitcoin spot ETFs.

It is evident that U.S.-based Bitcoin ETFs have facilitated an increase in basis trading. Therefore, it is important not to view each dollar of Bitcoin ETF inflow as equivalent to one dollar of buying pressure on Bitcoin. We estimate that $5 billion to $10 billion of the assets under management by Bitcoin ETFs are attributable to basis trading.

0 Comments