Something for your Espresso – Inflation.. Who cares?

Morning from Copenhagen.

The inflation report yesterday was decently hot across the board with headline printing at 0.2% MoM, core at 0.3% MoM and super core (core ex housing) printing just shy of 0.4%, which is really not what you were hoping for if you believed the Fed would be delivering more 50s this year, and we are seeing market pricing slowly carving 2x25bps in stone.

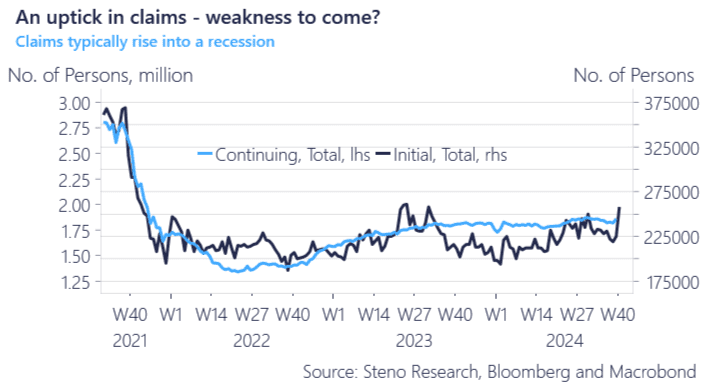

The caveat to the inflation report yesterday was the initial claims report, which was the first true weak report in months, printing at 258k – largest print since June/July 2023 – and the interesting thing here is that we saw a broad increase in claims across states with barely any states having decreasing jobless claims. We are talking about a decrease of 400 persons in the state where claims decreased the most, which is not something you would see in an outright upswing.

Could we explain the initial claims spike with weather- and strike-related events?

We have a Boeing strike ongoing, affecting around 33,000 workers, but it’s been ongoing for a month. There’s also the conflict involving Stellantis and UAW across various geographies, including Michigan, Ohio, Indiana, Texas, Arizona, Massachusetts, and Oregon, with a max impact on claims of around 15,000. This could also have some spillover effects on the supply chain.

As for weather-related factors, North Carolina and Florida have been impacted, but I’d be surprised if many people had already reached the claims queue ahead of the storm in Florida. The North Carolina spike is more obviously weather-related. If the Florida-hurricane were to impact claims, it would be reflected in next week’s report, not the one from yesterday.

The rise in claims is broad-based, so we should likely take this signal mostly at face value, in my opinion.

Chart 1.a: An uptick in claims

The inflation print yesterday was decently hot across most metrics, but it was overshadowed by a weak initial claims report, as it seems like all markets care about is still the employment side of things. Bostic has however opened the door for a pause in November, so what should we expect from rates here?

0 Comments