The Week at a Glance: The USD in the (Jackson) Hole amidst Over 1 Million Jobs Disappearing?

Welcome to our weekly “The Week At A Glance” publication, where we explore the most important key figure releases and tradeable themes for the upcoming week. We remain almost exclusively long on USD fixed income, and therefore, our attention is particularly focused on two key developments this week:

- The Jackson Hole Conference and Ueda’s Appearance in the Japanese Parliament

- Revisions to U.S. Employment Data: The Bureau of Labor Statistics (BLS) will release first-quarter 2024 data from the QCEW on August 21, 2024, at 10:00 a.m. (ET).

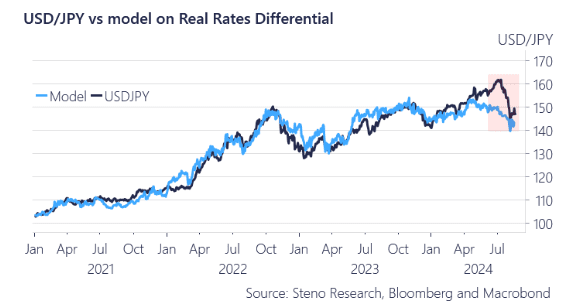

The Jackson Hole conference is of interest not only for its implications on forward pricing but also for the potential impact on the USDJPY pair, which is moving lower toward real-rate equilibrium levels (based on current real rates) around 142.

The revisions to U.S. employment data are significant due to the increasing focus on employment by the Fed. Both Goldman Sachs and the blog Zero Hedge have highlighted the possibility of substantial downward revisions, which could unsettle markets. As noted:

“On Wednesday, the Bureau of Labor Statistics will downwardly revise job figures for the April 2023-March 2024 period by up to 1 million. This means that all ‘beats’ recorded over the past year will have been misses, indicating that the U.S. job market is in far worse shape than the administration would admit.”

Chart of the Week: USDJPY still trading too high relative to real rates

Will Powell use the labor market as an excuse to cut rates quickly, while Ueda discusses raising rates in Japan? The QCEW-based revisions could give the Fed enough justification if they decide to move swiftly, even though the quality of QCEW data has been mixed lately.

0 Comments