Labor Watch: What if the Sahm Rule wasn’t even triggered? A contrarian labour market view..

Take aways:

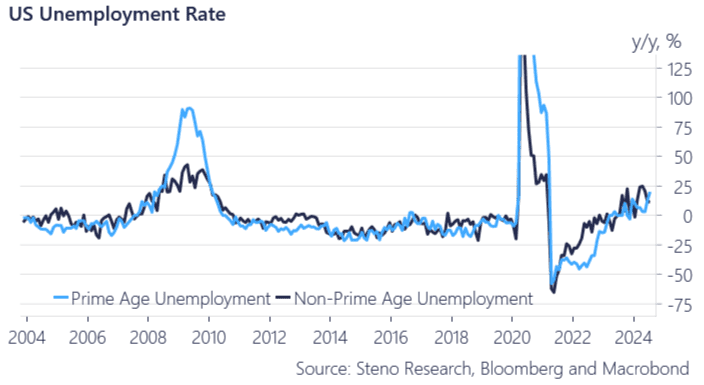

- Prime age unemployment looks to green light a rate cut

- ISM service employment surprising to the upside

- The Fed will take a decision in September based on hurricane-impacted numbers

- The Sahm rule would not have been triggered if it wansn’t for labor force entries and temporary weather related lay-offs

- The job market is doing much better than feared by many and the Fed Funds pricing is overcooking the easing cycle

With short term US yields moving slightly up again after Monday’s huge drop we have been focusing a lot on the US cycle. As we elaborated on yesterday, both the SLOOS and ISM services prints do not look particularly recessionary. We haven’t discussed labor data, which caused markets to worry leading up to this Monday’s dramatic downturn in markets; hence, this short piece.

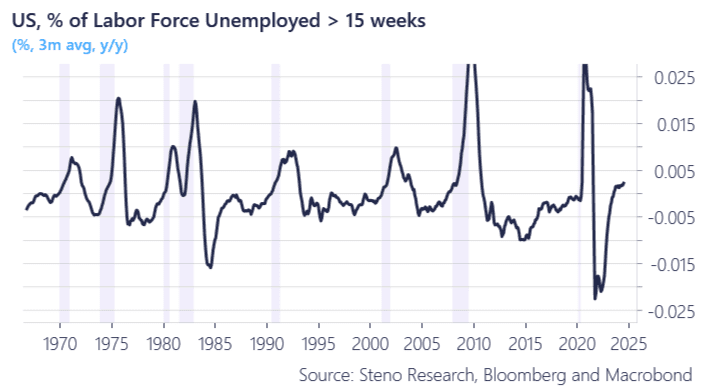

Unlike the ISM and SLOOS, there are reasons to be concerned about the labor print from last week, with some caveats. The most concerning aspects are the rise in prime-age unemployment and the percentage of the labor force unemployed for more than 15 weeks. Both indicators greenlight a rate cut by the Fed.

As mentioned above, the SLOOS and ISM services from this Monday appeared anything but recessionary and have likely contributed to the rise in US yields. The ISM employment print contradicts the weakness suggested by the one-month NFP diffusion index.

But, maybe the weakness is vastly exaggerated by technicalities?

Chart 1.a: In a historic context prime age unemployment starting to look worrying

Chart 1.b: Long term unemployment also ticking up

Recent US labor data presents mixed signals; while the ISM and SLOOS indicate no recession, rising long-term unemployment rates may prompt the Federal Reserve to consider rate cuts. We are of the view that the Sahm-rule was not actually triggered, as the rule doesn’t account for the current labor market mix.

0 Comments