Energy Cable: Why Chinese Flows Govern Gold Markets, Not Western Cutting Cycles

Hi and welcome to this week’s Energy Cable!

We will do a short note this week as many of you are mostly trying to extinguish fires due to the sell-offs in markets. We have two major themes regarding commodities that we’ll focus on today, namely gold and crude.

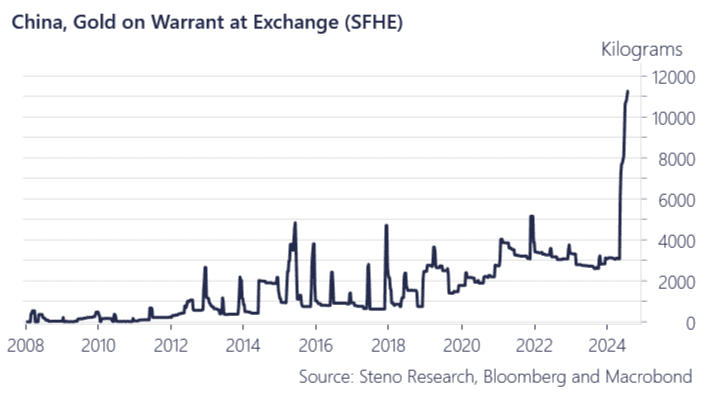

In 2024, the gold market’s narrative is predominantly shaped by China, where increased gold stock levels are observed despite lower trading volumes, keeping prices elevated. This decoupling suggests that while China accumulates gold, it does not actively trade it, which maintains high market prices due to limited supply. We have recently seen a significant accumulation of gold at the Shanghai Futures Exchange (SHFE), which is unusual and reminiscent of the major build-up of copper stock at the exchange during the spring before the wash-out of copper positioning over summer.

The recent appreciation of the yuan against the dollar may reduce the need for Chinese debasement hedges of the CNY via gold. We know how gold has been a source of USD access and liquidity. If the yuan continues to strengthen, it could increase the incentive for Chinese holders to liquidate their gold reserves.

Additionally, we’ve received considerable pushback on our short gold thesis, which aligns with a market that remains heavily long on gold already. We remain short and also see the risk of a USD rebalancing flow spilling over to gold through August.

Chart 1.a: China is suddenly posting a lot of Gold at exchange

Markets consider gold trading a safe bet during the cutting cycle, but Chinese flows will dictate the trend. Currently, they are not crystal clear from a directional perspective now that the USD/CNH tide has turned. Meanwhile, the outcome space of energy looks asymmetrically interesting.

0 Comments