Steno Signals #111 – More or less liquidity? More or less recession? More or less real?

Happy Sunday! What a week, and what a few months we have ahead!

To use the words of my friend Boris Kovacevic, “it’s like 2024 never happened.” Everything we learned about the re-acceleration of inflation in H1 and the “high for longer” narrative has just vanished into thin air over the course of a few days. While it is hard to disagree that a cutting cycle is commencing, it is still very much up in the air whether this is a normal cutting cycle.

We spent last week examining returns in various asset classes around the commencement of cutting cycles, and the saddening truth is that it very much depends on the type of cycle.

Bonds have fared well in basically all cutting cycles (no surprise there), but the returns across other asset classes are much more mixed. This conclusion also holds for gold, even if macro pundits and asset managers are flocking to media outlets with the assertion that gold will perform well in a cutting cycle. This is not even particularly true historically, and this cycle may also be very different from earlier cycles in many parameters related to rates, risk assets, and commodities.

Let me show you why!

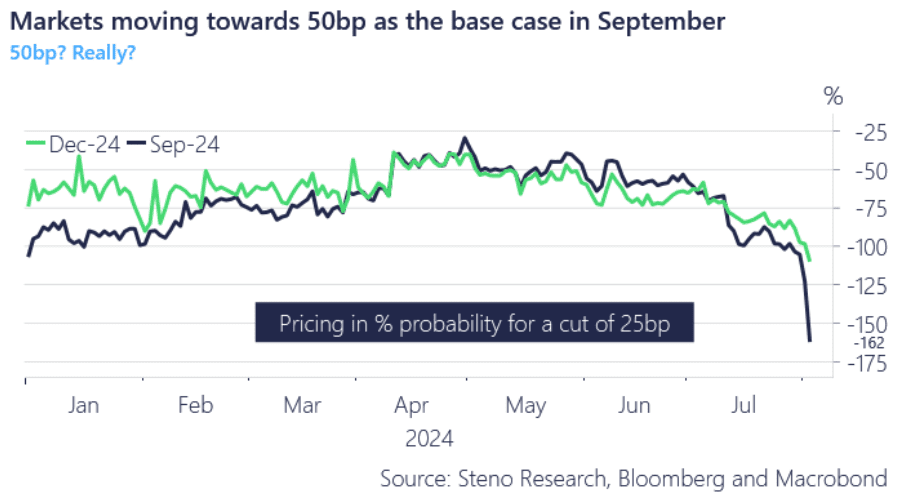

Chart 1: Markets going bananas on rate cuts

When examining returns around the first rate cut from the Fed, it’s typically not a time to panic in equities.

The last few weeks since the July CPI report have been tumultuous, to say the least. However, we have only seen one significant meltdown around the commencement of a cutting cycle, and that was in 2001. Otherwise, we have seen semi-orderly but admittedly highly volatile daily returns in equities within +/- 60 days of the first cut during cutting cycles.

In 2001 and 2007, the cutting cycles ultimately “ended in tears,” but they were also characterized by a lack of liquidity additions and no direct initiatives aimed at supporting risk assets. Quantitative easing in significant size has been implemented since then, and you know the drill by now.

Recessions differ in their impact depending on whether they are real or nominal, with the latter obviously being worse. Markets keep forgetting the nominal vs. real discussion this cycle, while the liquidity outlook is becoming increasingly mysterious.

0 Comments