The Week At a Glance: MPC members better prepare a Bailey for the Coffee, while Ueda better pray for a weaker JPY..

Welcome to the weekly “The week at a glance” publication where we look at the key figures during the week ahead and how to trade them.

The Fed will release their meeting minutes Wednesday, and it will be interesting to see whether they address the unfolding re-inflationary commodity bull run. The Fed is seemingly too honed in on arguments to cut rates, and have so-far more or less ignored the reflation-story. The continued dovish lean is looking to provide further tailwinds for risk assets, which are still enjoying the cocktail of benign liquidity conditions and a dovish miss in April’s CPI figure.

Let’s have a look at the details!

Event 1: RBNZ Holding Rates Steady, but..

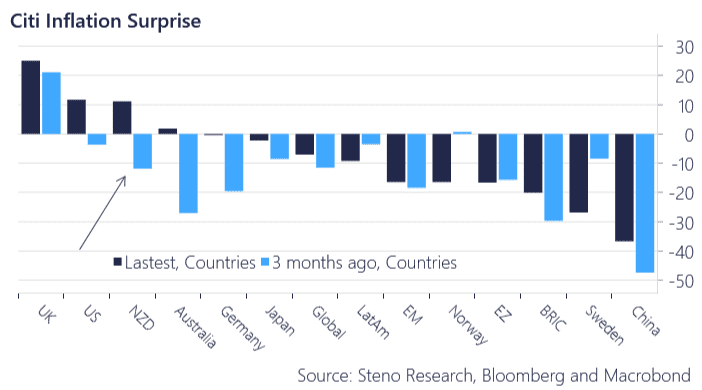

The RBNZ will release their interest rate decision Wednesday, likely going to show a continuation of the 5.5% cash rate, with recent inflation gauges from New Zealand surprising hawkishly on the margin..

The NZD has generally been weakening against G7 currencies which should be a concern to the RBNZ given inflation not being anywhere near 2% currently, which rhymes with the RBA’s problem of inflation getting sticky. Notably, the AUD has strengthened substantially against the NZD throughout March and April (New Zealand’s 2nd largest importer), while the NZDCNY cross has remained fairly stable (New Zealand’s largest importer). As we’ve been banging the drum on, China is starting to export Inflation again in scale, which is no good news for neither Australia nor New Zealand, and RBNZ is therefore at risk of (like the Fed) of an easing bias into a

However, the RBNZ is amongst the most dovish Asian / Oceanian central banks in forward pricing, with the positive surprises to inflation not really moving pricing a lot. In fact, pricing has only moved one way since late April: south.

Chart 1.a: NZD-flation amongst the top hawkish surprises

Action-packed week ahead with overseas central bank action, while we get PMIs and CPI prints at home. The FOMC meeting minutes will likely steal the stage and set the tone on markets Wednesday, and we’ll see whether they address the ongoing commodity-driven re-flation cocktail.

0 Comments