Quant Signals

Our quantitative signals are the result of extensive trading experience combined with quantitative expertise. By leveraging our knowledge of market dynamics, we analyze vast amounts of data to identify the most actionable and tradeable signals across asset classes. To gain access to the quant signals, reach out to one of the Steno Research team members on Bloomberg or via email at [email protected]. They will provide you with further instructions or details on how to proceed. Please note that Quant Signals is ONLY available through Bloomberg.

quantitative intraday mean reversion strategy

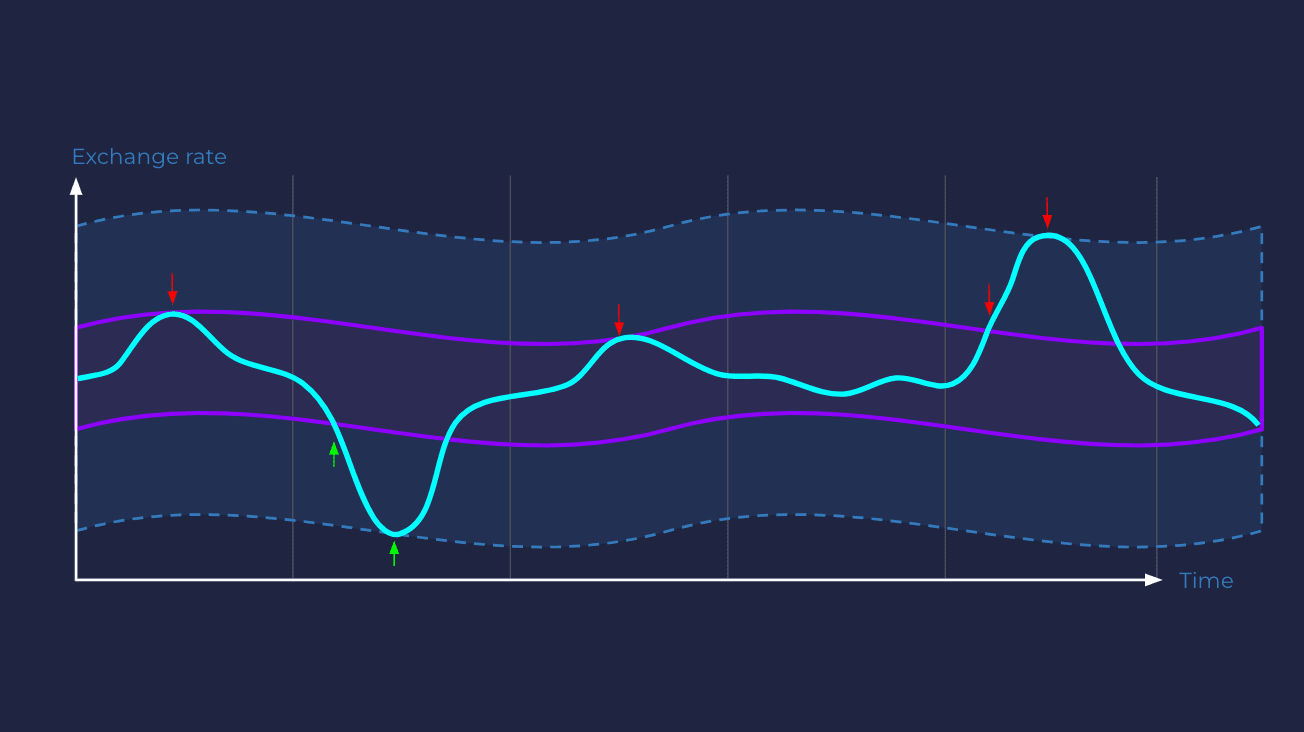

Our quantitative intraday mean reversion strategy is derived from years of trading experience coupled with quantitative expertise. Leveraging this knowledge, we employ the GARCH process to analyze volatility and predict future market movements. Our proprietary GARCH model captures the dynamic nature of volatility, accounting for its non-constant behavior and its dependence on both the volatility path and past prediction errors.

Our proprietary GARCH model swiftly adjusts to new information, enabling us to capture changing market dynamics with precision. This adaptability allows us to stay ahead of evolving trends and make timely decisions in response to market shifts.

By meticulously crunching data, we uncover the most actionable and tradeable intraday mean reversion signals, empowering us to make informed investment decisions. Additionally, an integral component of our decision-making process is our comprehensive backtesting framework, which consolidates all relevant information and ensures thorough analysis of historical data. This vehicle provides valuable insights into the effectiveness of our strategy across various market conditions, allowing us to rigorously test our approach and gain confidence in its robustness and adaptability, ultimately empowering us to make informed decisions with greater certainty

FX-HEDGE REBALANCING MODEL

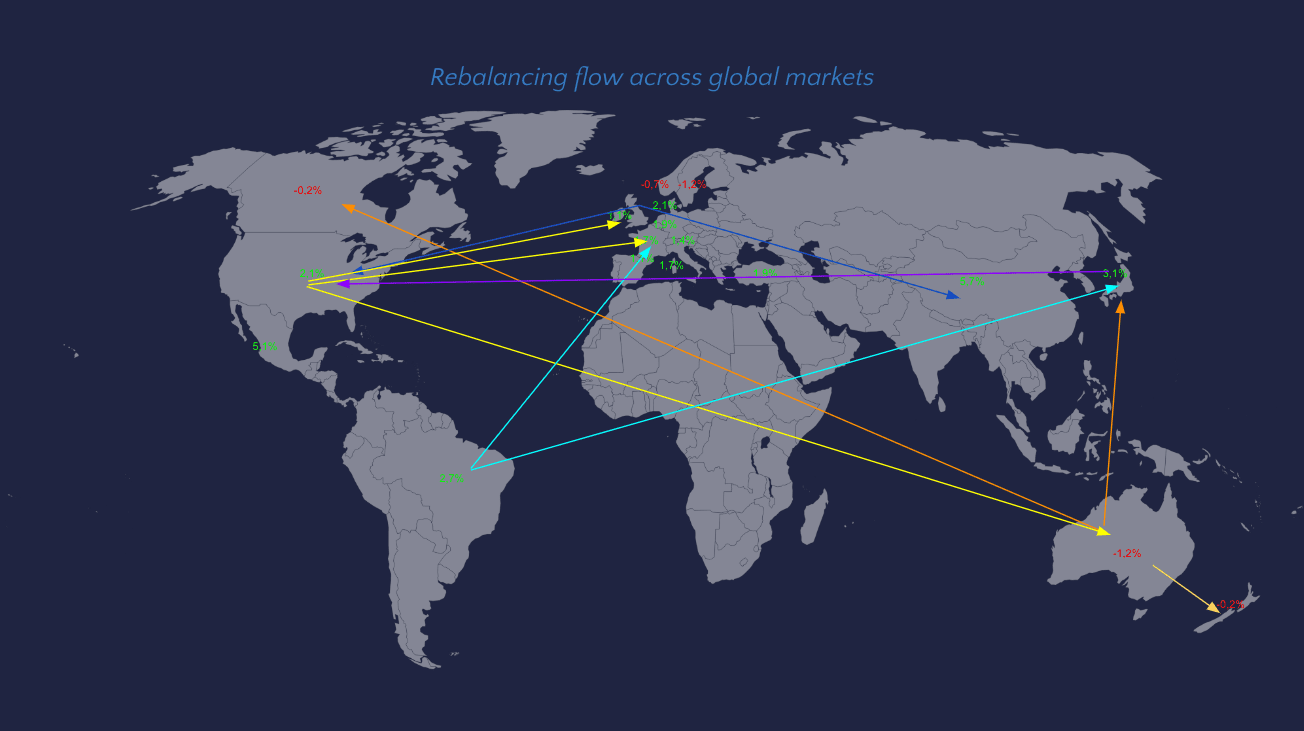

The FX market often mirrors price movements in other markets, a phenomenon captured precisely by our FX-hedge rebalancing model. Real money investors holding foreign assets must hedge their FX exposure and adjust their hedge as the value of their foreign holdings fluctuates.

While this principle is straightforward, achieving precision across multiple markets is relatively complex. To address this complexity, we map cross-border holdings across major economies while monitoring the performance of various markets. This enables us, in a quantitative way, to calculate with high precision estimated nominal rebalancing of FX hedges and rolling Z-scores on a continuous basis.

Based on the calculations, we share systematic and rigorously backtested trading signals.

Steno research pca model

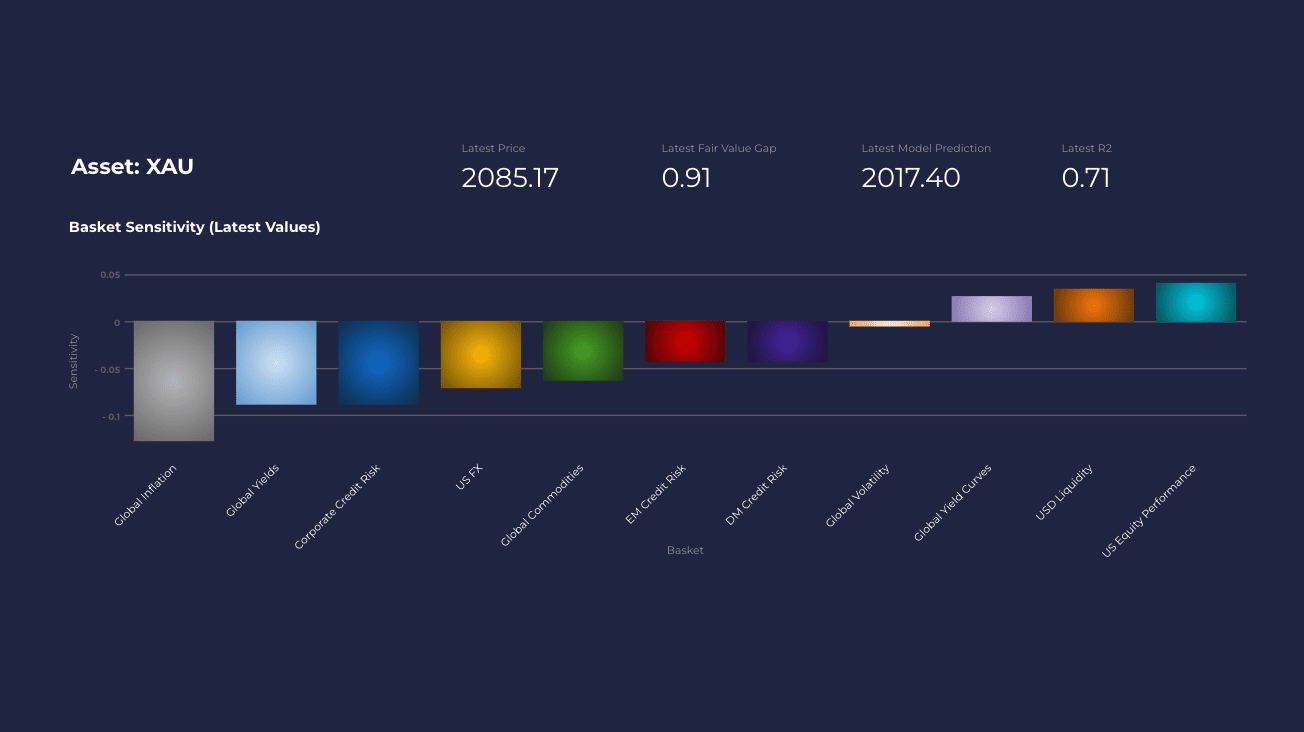

We have defined what we consider to be the most pivotal macro baskets, each comprising several underlying factors. It’s important to note that these macro baskets vary across different asset classes, reflecting the unique characteristics and dynamics of each market segment.

To effectively dissect the macro landscape of any asset, we leverage the power of Principal Component Analysis (PCA). This sophisticated tool serves as an efficient method for mapping out the macro anatomy of a given asset, allowing us to uncover underlying patterns and relationships that may influence its price fluctuations and market dynamics.

By utilizing PCA, we gain a comprehensive understanding of the underlying drivers shaping the performance of various assets. This deeper insight enables us to identify key trends, anticipate market movements, and make informed investment decisions with greater precision and confidence.

Furthermore, armed with this enriched understanding of market dynamics and supported by our robust backtesting vehicle, we are better equipped to develop and implement trading strategies that capitalize on emerging opportunities and mitigate potential risks. Through thorough analysis and strategic insight, we strive to deliver consistent and sustainable returns for our clients, navigating the complexities of the financial landscape with agility and foresight

Meet the team

Claus Venderby Hornsleth

Head of Quantitative Signals

Claus has 20 years of experience from the financial sector. Very extensive experience with derivatives, macro trading, tactical trading, risk management and understanding the fundamental & technical drivers of the financial markets. With a data-driven process, he is using his extensive experience to provide meaningful insights and sparring with substance.

Alex Mealor

Senior Quantitative Analyst

After numerous years working in FX Hedge Fund Sales at Barclays Investment Bank in London, Alex joins Steno Research as a Senior Data Analyst having recently repositioned into the Data Science field. His established background in markets and technical capacity see him focusing on the data architecture and analytical offering for Steno Research.

Bastian Jørgensen

Junior Quantitative Analyst

Bastian is the Quantitative Analyst at Steno Research. A valuable asset to the data team, Bastian leverages his expertise in statistics, probability and data-driven decision making to design groundbreaking, statistically sound solutions for the company. Before his tenure at Steno Research, Bastian was building algorithmic trading strategies for a prominent daytrader.