|

|

|

Written by Ulrik Simmelholt

|

- No container shipping through Suez towards Europe and price increases ahead

- Energy and dry bulk shipping is still alive

- Expect transportation and apparel to see price increases in Europe

- Hedging 2024 portfolios with long Shipping bets and/or long Energy bets make increasing sense

Happy New Year everyone! Things are escalating in the Red Sea as shipping giants such as Maersk and Hapaq-Lloyd haven’t been convinced by the military efforts in the Red Sea and have now completely avoided transporting goods from Asia to Europe through the Red Sea. That can be seen in prices which have seen one-way traffic the last week.

|

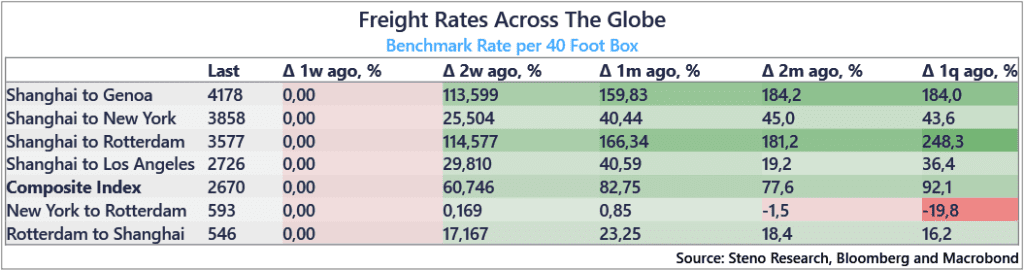

Freight rates are up >100% this week, and we hear from sources that Maersk is now suggesting an all-in rate of USD 6000 TEU. These costs encompass additional costs such as war premium, issuance, legal and extra crew. Furthermore, Maersk is considering the option of entering into Time Charter (TC) agreements for durations of 8-12 months under these terms, responding to customer concerns about delays in receiving goods for the summer season.

|

Chart 1: Freight rates are rising fast

|

|

|

On the other hand, as seen in chart 2.b there is still life in the shipping of crude, LNG and dry bulk in the Red Sea. The Houthis have properly made the calculated bet that attacking energy related shipping would risk drawing rich oil countries in the region into the mix. This alleviates some potential stress on Europe wrt. price increases.

|

Chart 2.a: No container ships heading towards Europe through the Suez Canal

|

|

|

Chart 2.b: Still life in dry bulk, crude and LNG

|

|

|

If we look at the sensitivity of HICP to 40 foot freight rates from Shanghai to Rotterdam, we see that the transportation and apparel subcomponents will likely see tailwinds m/m in the inflation indices on the back of this. Given that LNG and crude still flow through the Suez and that prices more broadly haven’t moved to a large extent, we discount the effects of freight rates on the electricity, gas & other fuels component.

|

We still don’t see this becoming a broad inflationary story in the EZ with other components showing strong disinflationary trends., but there are increasingly good reasons to hedge 2024 portfolios in either long Shipping bets and/or energy bets.

|

Chart 3.a: Apparel and transportation will likely see price rises

|

|

|

Chart 3.b: Price for dirty Suezmax haven’t moved over the last days

|

|

|

Lastly we note that freight rates on LNG out of the US are also tumbling over the last week proving how weak the current gas outlook is even with headwinds from the Houthis.

|

Chart 4: Both Japan and Europe with benign gas outlooks

|

|

|

Our views are once again underpinned by the weekly EIA implied demand data.

|

Gasoline demand was very strong in December until week 52 (which is not unusual) and we have seen record high seasonally adjusted demand in week 50/51 (see chart 5.a). This bodes well for the long energy bet short-term.

|

Meanwhile, the Nat Gas demand remains muted and December led to strong net inflows to storage from a seasonally adjusted perspective (see chart 5.b)

|

Chart 5.a - Gasoline demand was SUPER strong in December

|

|

|

Chart 5.b - Nat Gas demand was weak in December

|

|

|

|