|

|

|

Written by Ulrik Simmelholt

|

- Booking profits in crude, staying long in broader metals

- Crude predicting ISM to turn in 6-9 months time

- Sluggish German IP ahead

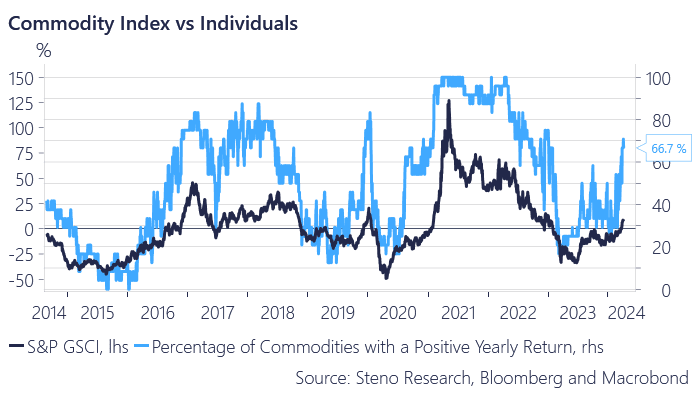

Last week, we reached our profit level in crude oil, leading us to exit the trade successfully. Our outlook remains bullish on commodities, spurred by what we perceive as a reflation head fake. This optimism has prompted us to enter a long proxy-position in the Bloomberg Commodity Index (BCOM), as we observe the rally widening across the commodity complex (Chart 1).

We have also entered a few trades in the metals space (both physicals and equities) as we continue to harvest returns in this space after a great run.

|

Chart 1: The rally becomes broader and broader

|

|

|

Although the commodity rally is broadening, it's important to note that this is not yet an all-out bull run. The ongoing real estate challenges in China continue to impact steel prices, indicating the sector's vulnerability. Meanwhile, copper prices are holding strong, suggesting a pivotal shift in China's economic focus—from a real estate-heavy model to one that prioritizes technology, semis and EVs..

|

Watch the copper stock levels closely over the next weeks for signs (Chart 2.b). We still don’t know, looking solely at that, if China is planning on pulling out the world’s biggest stimuli canon for metals or if demand is so sluggish that stock levels are building.

We mainly subscribe to the view that China is restocking for tactical purposes, which is in line with the restocking efforts seen across the globe in Manufacturing to take advantage of relatively low prices ahead of a perceived upswing in goods production.

|

Chart 2.a: China reflation? Depends which commodity you ask

|

|

|

Chart 2.b: Chinese copper stock levels are through the roof

|

|

|

From chart 3 we can see that the strength in crude oil now suggests that we’ll be in the destocking cycle 6-9 months from now which usually rhymes with lower US PMIs, which is one of the reasons why we have labeled the reflation a head fake.

|

Chart 3: The US will be in its destocking cycle in 5-6 months

|

|

|

Cyclical head-fakes can prove extremely powerful in nature as we are moving out of a low-activity environment in the physical economy, which has caught both commercial -and speculative agents off guard on hedging demands.

We are now at a stage where price expectations start increasing due to the necessary restocking among Manufacturers, which feeds a self-fulfilling loop in commodity prices.

|

Once expectations rise, commercial users of the commodities increase their buying of commodities to hedge against price increases, which in turn creates even further increases in the price and therefore also expectations for future inflation.

|

This loop will likely continue until it is broken by an exogenous factor, such as a central bank stepping in and the feedback loop obviously also works in the other direction once the snowball rolls.

Judging from our proprietary input cost impulse indicator, we have an outright MELT UP ahead of us during Q2 and we favor Silver as the most direct expression of this view, why we have bought into the Miners trade last week.

Chart 4: A melt up in commodities right ahead of us?

|

|

|

Europe has not been immune to the global reacceleration of commodity prices, as evidenced by the rising costs of crude oil. Both crude oil and natural gas have historically served as reliable predictors of headline inflation, highlighting the broader economic implications of their price movements. Currently, Europe may find some relief in the fact that natural gas prices have not yet succumbed to the reflation trend.

|

Our high-frequency gauges of manufacturing activity in Europe indicate that the continent is unlikely to increase its gas demand anytime soon. This observation suggests a continued moderation in energy consumption within the manufacturing sector, reflecting broader economic trends across Europe.

European IP will only improve once we see cheaper input prices and only then will we start seeing companies returning to pre 2022 gas demand.

Judging from our German nowcasts (chart 5.b), Europe's (former) industrial powerhouse is not yet out of the woods and the global reflation in commodities is hence mostly driven by China/Asia and the US at this stage.

You can always follow our portfolio live here

|

Chart 5.a: Crude oil will impact headline HICP

|

|

|

Chart 5.b: Don’t expect Europe to go gas bonanza any time soon

|

|

|

|

|

|