|

|

|

- The Chinese rally seems driven by talk rather than action- a warning to bulls as it is could reverse as swiftly if the rumours dissipate or prove unfounded

- We prefer to maintain a long position in China but through proxies with broader exposure, despite appealing low valuations in equities.

- While there's debate over US growth, markets are reevaluating it upwards, and we remain bullish on risk and the USD.

- We are beginning to observe hints of fragility in Mexico, raising questions about a potential cooling effect that could destabilize the MXN.

While it comes as no surprise that there is a noticeable emphasis on boosting market sentiment in response to the recent violent sell-off that Chinese authorities have attempted to counter through various legislative measures and adjustments – including short-sell bans, heightened supervision of companies with inadequate dividend payouts, promotion of buybacks, and, more recently, state fund interventions – the reported sums circulating in the markets these days remain remarkably high.

|

If the intention was to bolster market confidence, it is safe to say that the initial response has aligned with those objectives. However, it is crucial to recognize that the recent turbulence in Chinese risk assets is indicative of more profound issues. Relying solely on state fund interventions to artificially inflate market values is not a sustainable, let alone prudent, approach to address the underlying challenges confronting the Chinese economy.

|

Back before Christmas, I wrote the following highlights for a piece on China for 2024:

|

"- Foreign confidence remains a massive issue for investment and equity pricing. Efforts for diplomatic damage control seem to be a cheap option when contrasted to the domestic issues related to adding more leverage to the system as an alternative

– Domestic confidence is arguably even lower with households seeing little light at the end of the tunnel. We can see why they won’t. Unless there are major changes in real estate policies or ambitious measures, we don’t expect a significant boost in private consumption. Therefore, fiscal policy is likely to take center stage in 2024.

– Monetary policy will aim at balancing a backstop of the insolvencies within the financial system whilst adding as little pressure to the Yuan as possible and accommodating increased financing needs for the state. Still, we think 2024 will offer gradual front-end cuts"

|

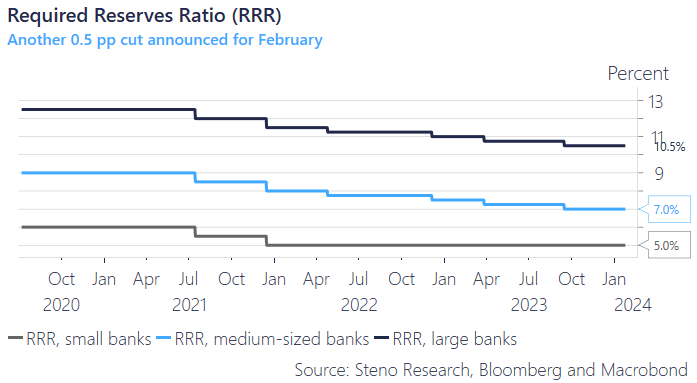

Not how that last sentence has essentially proved to be the first pawn that the Chinese leadership has chosen to move, which implicitly proves that the 2023 preferences are still intact: The exchange rate matters, and the capital flight needs to be backstopped and that remains the priority vs easing the burden on the rate-sensitive sectors that are currently dragging the economy down. The reduction in the Reserve Requirement Ratio (RRR) injects liquidity into the financial system while maintaining a level of stability in the fixing process. This marks the deployment of the first tool in the anti-crisis arsenal.

|

|

|

The surprising decision to maintain the front-end rate unchanged earlier this month, despite market expectations of another cut, clearly reflects the priorities of the CCP. Today's press conference marks a significant departure from past practices.

|

This live announcement of an RRR cut with the markets still open underscores a sense of urgency, and the promise of increased liquidity in Q1 may hold some weight. Nonetheless, it's essential to recall that 2023 was characterized by a continuous stream of unfulfilled promises from policy officials, culminating in a rather lackluster and conventional stimulus package. Given this recent history, it's plausible that Chinese authorities are emphasizing their intentions, which aligns with their apparent preference for adjusting the RRR rather than the policy rate.

|

As our loyal subscriber base can attest to we have jumped early on the bandwagon and have currently made a decent penny on the market fronting more policy easing from Beijing

|

But not through direct risk asset exposure; instead we are long copper which thrives well with a positive Chinese liquidity impulse and a repricing of growth:

|

Chart 2: Copper vs Hang Seng

|

|

|

The heightened speculation in the markets has likely led to the early pricing-in of Chinese stimulus measures in mainland equities. However, we strongly advise caution to all adventurous Western investors. A single misstep or ill-advised remark from "Bloomberg's sources familiar with the matter" could trigger a market downturn, highlighting the drawdown risk in this situation.

|

Dealing with the world's largest asset bubble in an economy marked by decelerating growth and debt levels that are out of sync with its stage of economic development, all while grappling with near-deflationary conditions, presents a multifaceted challenge. Mere interventions such as purchasing risk assets and cutting reserve ratios will not suffice- nor will empty rhetoric for that matter. We suspect that, until policymakers reach a higher level of concern (which is still debatable), they will refrain from taking bold actions. Moreover, the necessary reforms to address the overinvestment/underconsumption problem remain incongruent with the policies currently championed under Xi's "Common Prosperity" initiative.

|

Our perspective maintains that any future stimulus efforts will likely fall short of expectations and lean towards supply-side measures, along with less productive domestic investment. Both of these approaches align with the idea that additional leverage will yield diminishing returns

|

Chart 3: China's debt ratio vs DM's

|

|

|

Instead of piling into mainland risk, our long copper offers the diverse exposure from a repricing of not only Chinese growth but industrial activity globally. I have received quite some blowback from my Q1 recession call and that call still looks thin here on the back of what seems to be a repricing of US growth.

|

The preliminary S&P PMI numbers came in hotter than expected and US consumers still look to be out in force in recent surveys. Add to this that ISM Orders are still outpacing existing inventory, something industrial metals should benefit from too.

|

Chart 4: ISM Orders/inventory ratio

|

|

|

BUT I might add that labour market data still looks fishy (to say the least) and the many accumulative months of the unemployment rate maintaining compressed combined with remarkable revisions in pay-roll data makes me less inclined to throw in the towel just yet.

|

We will probably not know we are in a recession before we are months into it and markets won't plummet on unknowns but the notable deacceleration of the Atlanta Feds Nowcast model (and other ones for that matter) marks that a cooling of the economy is coming in fast. Whether the recent easing and probably strong data print for January coming in soon will be enough to avoid a contraction near term is too early to tell.

|

Chart 5: Atlanta Fed Wage Growth Tracker vs GDP Nowcast

|

|

|

Nonetheless, I did notice some indications that cynically support my recession thesis this month. It appears that the substantial rate repricing is not translating into elevated demand expectations south of the border, and retail sales in Mexico disappointed in November.

|

Whether we witness significant improvements in the post-Powell data remains uncertain. Still, it raises the question of whether this could mark a reversal in one of the most popular FX trades of recent years, even if the disappointing print turns out to be an anomaly

|

Chart 6: Mexico Data, Bloomberg Calendar (expected print left, actual in the middle)

|

|

|

If the United States is indeed performing exceptionally well, but imports from Mexico have plateaued, we observe an intriguing divergence that may pave the way for a significant MXN carry trade disruption. Moreover, the resurgence of Trump in the primaries, unless legal obstacles intervene, is a noteworthy development. Interestingly, Mexico itself is in the midst of its own election, and Mexico City does not enjoy the privilege of using USD.

|

Adding to the complexity is Mexico's fiscal situation, with a projected deficit in 2024 hitting a 30-year high, and the impending need for tax reform in 2025, which could exert further pressure on the MXN.

|

Traditionally, MXN tends to exhibit weaker performance in the 90-day period leading up to the Mexican elections, starting on March 1st, aligning with the official campaign period. Although opinion polls indicate a likelihood of policy continuity, there remains lingering uncertainty about the fiscal policies of the presidential candidates, rendering market stability contingent on maintaining the status quo.

|

Biden may indeed push the envelope in the coming months but that is unlikely to undermine the UST wrecking ball and the USD performance.

|

In other words, the chart below is NOT USD bearish but a "promise everything election" in Mexico is MXN bearish.

|

Chart 7: Approval ratings, Biden even more unpopular than Trump doing 2016-2020

|

|

|

US imports from Mexico reached their peak in early 2023, but despite a positive current account print for Q3, we anticipate a potential reversal in the Peso's otherwise impressive long-term trend during the election season. While Biden's administration has been cooperative and favored Mexico as a "reshoring" candidate, I have reservations about Trump taking a similar approach. His China hawkishness and "they are taking our jobs" rhetoric, coupled with punitive threats, may resurface, reminiscent of the USDMXN spike during his 2016 win. The question is whether this scenario will favor a gradual MXN washout.

|

We have yet to decide whether to incorporate exposure to this view and are currently deliberating our decision

|

If you would like to be informed in real-time and track ALL of our trades you can subscribe to Premium, right here

|

Chart 8: USDMXN vs US Imports

|

|

|

|

|

|