|

|

|

***In our “out of the box” series, we aim at being ahead of the current consensus narrative and think of the next theme that could drive price action before anyone else has given it any noteworthy attention. The conclusions will most likely annoy you, but that is the whole purpose of the series. To think about the unthinkable before it happens.***

|

In this edition of the Out of the Box series, we take a look at the inflation in necessities and whether it is fair to assume that sticky inflation has become the new transitory. Will 2023/2024 prove to be 2021/2022 in reverse?

|

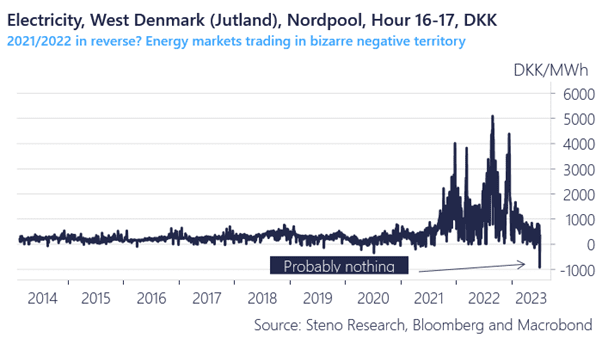

I woke up yesterday to a message from my power company that I would be paid to consume electricity. The peak hours 4-5 pm were priced at -1000 DKK/MWh in West Denmark and close to -1900 EUR/MWh just south of the border in Germany. These are unprecedented price levels and complete uncharted territory for electricity prices.

|

The vanilla takeaway is to shrug this off as a weather-related one-off with an extraordinary combination of wind and sun during a weekend, leaving Power-companies no choice but to pay the consumer to consume, but this was the exact same thing that initially happened in 2021 and early 2022 just in reverse.

|

Remember the stories of a weak wind season in Europe paired with a drought in Norway? This was used as an excuse for high energy prices in 2021. It sounds an awful lot like today in reverse and we all know how it all ended in 2022.

|

Chart 1: Nothing to see here in Danish electricity prices

|

|

|

The sudden occurrence of weird microcosms of extreme inflation in 2021 coincided with the extreme increase in the broad supply of EURs and now we suddenly see the first signs of weird microcosms of deflation while the broad supply of money is shrinking?

|

Is it a complete coincidence or is something more structural brewing beneath the surface? The below correlation is at least interesting to investigate further.

Chart 2: Maybe it is just all about money?

|

|

|

My working hypothesis through 2022 has been that the inflation of necessities dictates broader inflation trends when food-flation, energy-flation and shelter-flation becomes pronounced enough.

|

As soon as inflation feeds through to food, gasoline and rents, employees have no other choice than to ask for compensation. When only house -and equity prices rise, wage-flation remains nowhere to be seen (see 2010-2019 era).

|

German companies now EXPECT to lower prices of energy, food and other necessities. This ought to be a game-changer, but does this thesis actually pass a reality test?

|

Chart 3: Lower selling prices ahead on necessities according to IFO companies

|

|

|

Every time we have seen outright deflation in necessities (a basket of food, gasoline, electricity, water, health-care, clothing and rents), core inflation has subsequently followed suit and printed BELOW target within 1-1.5 years. Why? Because wages shadow-track the inflation in necessities.

|

Take a look at the relationship between wage growth and inflation in necessities in Europe below and do also note that we will have deflation in necessities already by September/October just at current price levels due to base effects (dotted line).

|

Will history repeat itself? Not necessarily, but it is likely going to rhyme..

|

The fear of a price/wage spiral is in our opinion unwarranted as necessity inflation is already normalizing, which will feed through to the wage formation.

|

|

Chart 4: Inflation in necessities lead wages

|

|

|

And wages and core inflation are of course closely related, why the price of necessities is essentially what you should watch - especially when food-flation, energy-flation and rent-flation is on the move.

|

The combined necessity index is within 2-3 months of reaching negative territory and wages and core inflation will likely follow.

|

The -1900 EUR/MWh peak-hour electricity price in Germany can easily be explained away by weather phenomena, but we find it unwise to do so.

|

Deflation in 2024 is an actual risk in Europe. Maybe “sticky” is the new “transitory”?

|

Chart 5: Core inflation lags necessity-flation

|

|

|

|

|

|